How Much Do Accountants Charge To Do Payroll

However there isnt a simple answer to how much will payroll cost and there are a. Typically accountants nationwide cost between 30 and 300 per hour.

C-Corporation Form 1120 350 minimum charge.

How much do accountants charge to do payroll. Limited company 40 to 250vat per month for accounts tax returns and payroll is. Tax N Book in Charlotte North Carolina. I charge a flat rate of.

Find out how much it costs to use a payroll company and how it compares to having a CPA run payroll for you. Standard Payroll Processing Rates Our standard payroll. 52 weeks x 4 per weekly payslip x 5 staff.

Bookkeepers charge between 25hr and 90hr Accounting work completed by a CPA youll find a range of 150hr to 450hr This means that the bill for services provided will vary depending on how long it took your bookkeeper or accountant to complete those services. How much do accountants charge to do payroll. The cost of payroll services varies depending on how much support your business needs with managing payroll.

That we only provide a payroll service to clients where we are engaged to act as their Accountant. A man that holds a cat by the tail learns something he can learn no other way. Online payroll services typically charge a base fee of 29 to 150 plus 2 to 12 per employee.

At current market rates youll find a range of hourly rates. If youre a contractor or a freelancer fees can be anything from 50 to 150 per month and that will cover having your accounts done filing of your VAT forms Self Assessment forms bookkeeping payroll end of year submissions and filing with Companies House if a limited company. 25 per employee would be a retainer up front.

I think that a charge of 10 to set up each payroll run and then 4 per payslip on each run is about right. How much does an accountant cost typically for the following services. So outsourcing your entire payroll facility to a fully-managed service is the most expensive option at around 10 per employee per month depending on many employees you retain discounts are often available to businesses that hire a greater number of people.

So if the company has say 5 people on the payroll and pay is weekly the cost would be. While rates vary greatly according to the services rendered Thumbtack estimates that average monthly accounting fees can range between 75 to 175 per month. Accounting costs are determined by the size of your business and your accounting needs.

Your company uses a payroll service provider that charges a 40 monthly base fee and a 3 fee for every employee you have each pay period. We are not a payroll bureau. More if their records are a mess and require organizing.

35 per month per company 4 per employee per month. This means that every two weeks you would pay the following amount for payroll services. Individual tax return 75 to 400vat per annum.

50 -60 a quarter if there is no client intervention. 52 weeks x 10 520 for the year. Income Form 990 200 minimum charge.

If you havent been doing the payroll and they just want W2 done I would charge at least 25 per employee. Self-employed tax return and accounts 250 to 1000vat per annum. 6000 a month for the more than 10 employees and a wee bit complicated.

AL C-Corporation Form 20. Pricing varies depending on services provided the payroll companys experience and other factors. S-Corporation Form 1120S 350 minimum charge.

The cost will typically depend on the size of your business. Some companies choose to outsource HR at the same time which of course would raise the price of monthly payroll. How many bank accounts need to be reconciled.

The charging rates shown below are for the 20202021 tax year and are updated every 05 April. So a total of 1560 for the year. 30 a month if I am given varying hours or weeklymonthly changes - up to 9 employees.

Some accountants charge by-the-hour for consultation services short-term assistance sorting out bookkeeping issues or one-time help to get new accounting software up and running. An accountant performing the basic accounting services will usually work for between 25 and 35. While there are other areas you should be evaluating such as payroll features customer service support cost is always a top thing to consider when running a business.

Partnership Form 1065 550 minimum charge. 40 2 3 x 10 20 30 50. Return of Organizations Exempt from.

If your business employs under ten people you can expect to pay around 400 per person for monthly payroll processing. Factors that influence the monthly CPA rate include. Here are three examples of monthly rates for payroll services.

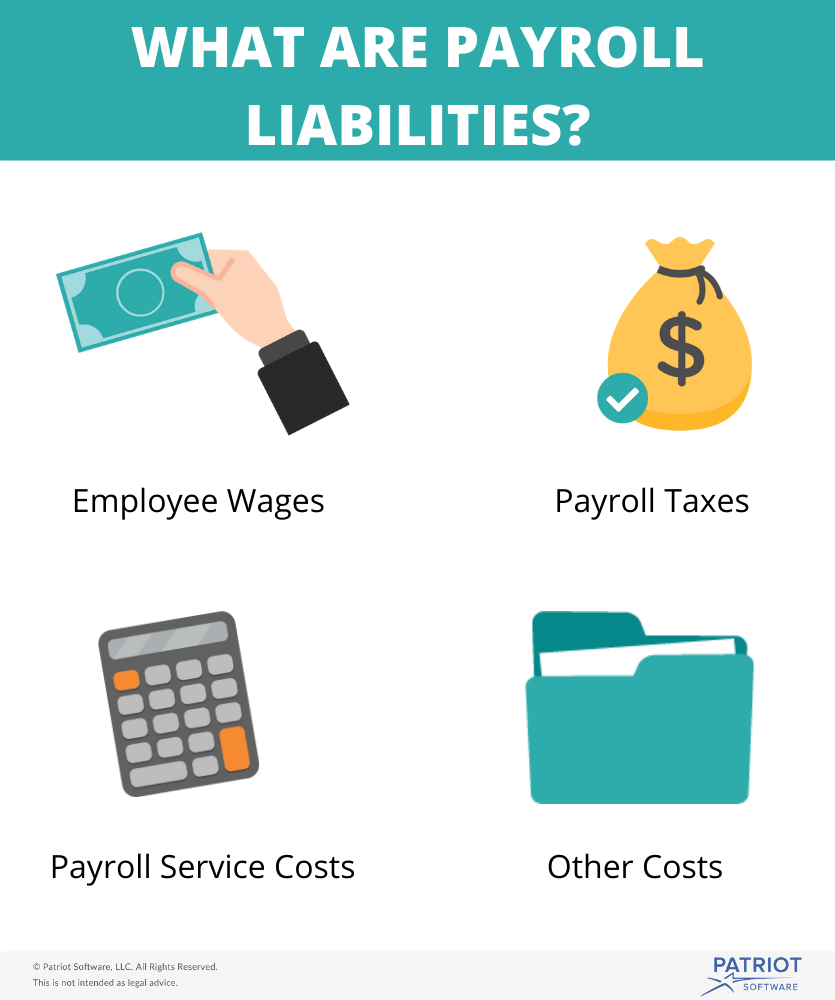

What Are Payroll Liabilities Definition How To Track Them More

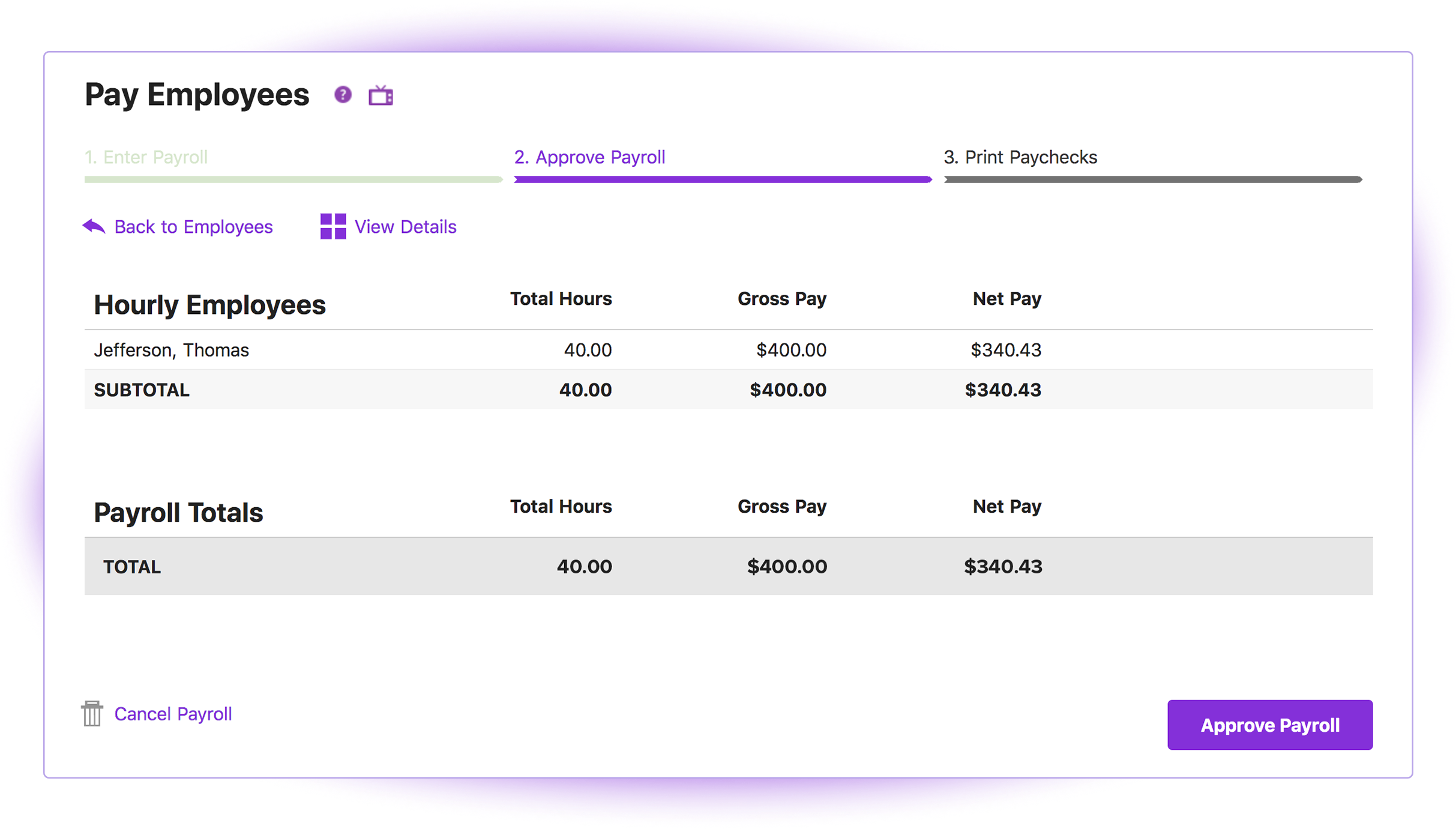

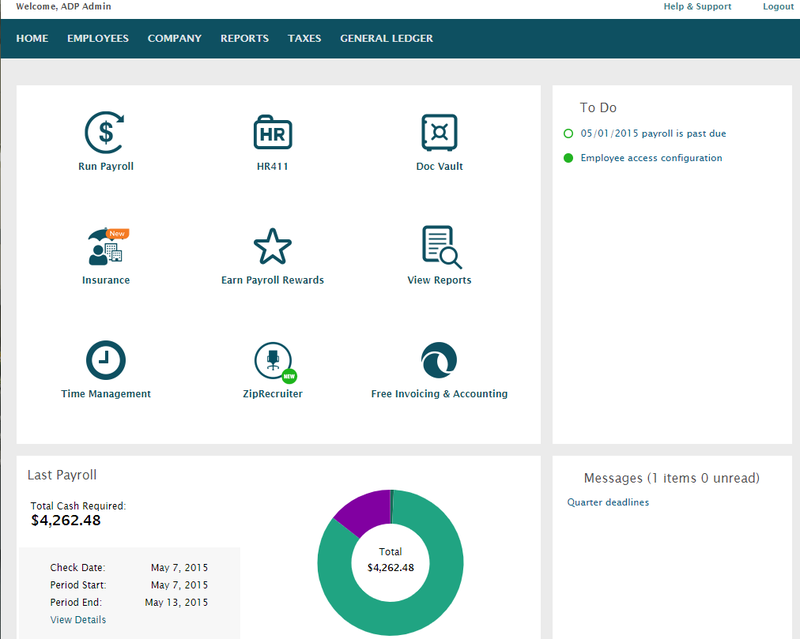

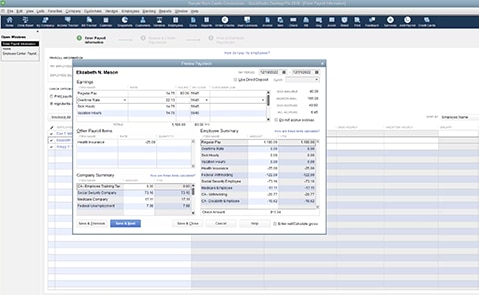

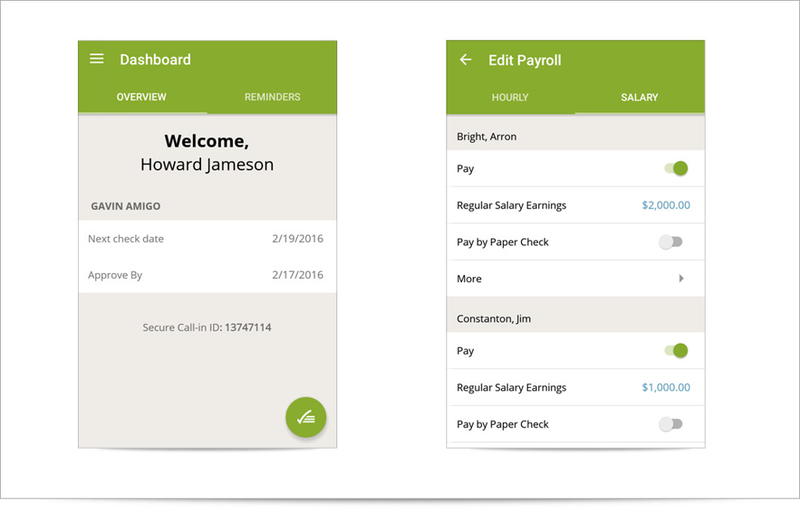

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

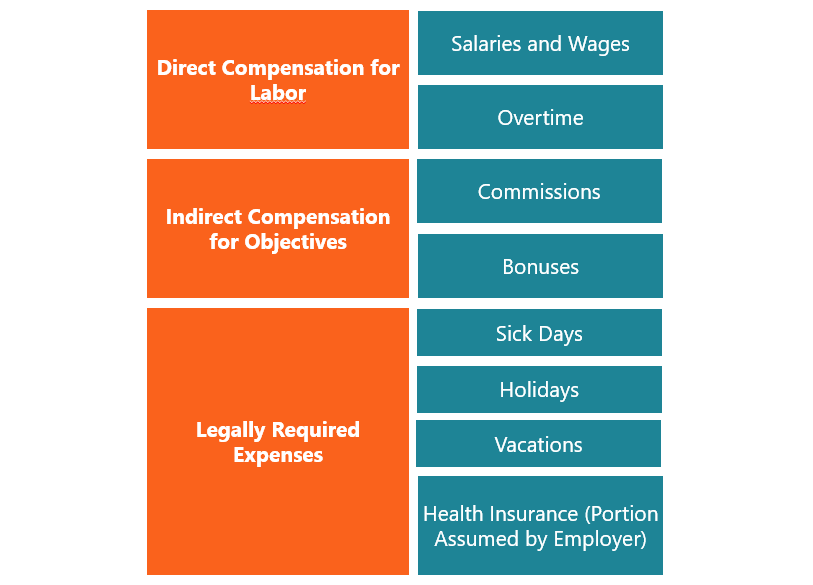

Understanding How Much Small Business Payroll Costs

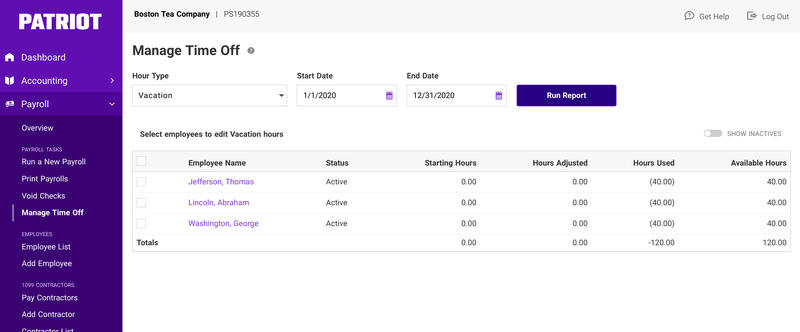

Patriot Payroll Software 2021 Reviews Pricing Demo

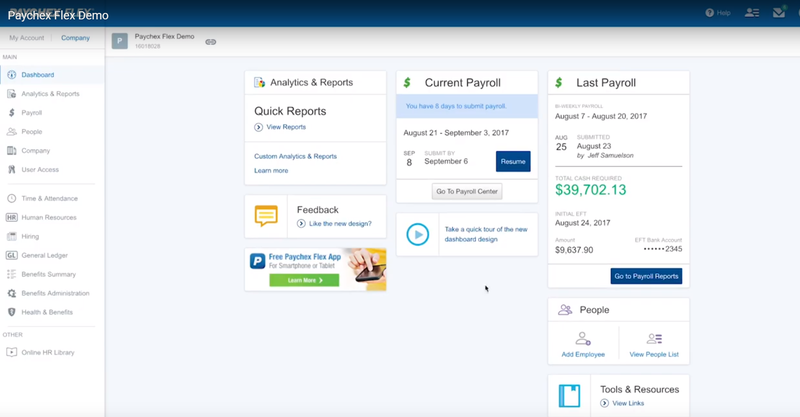

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

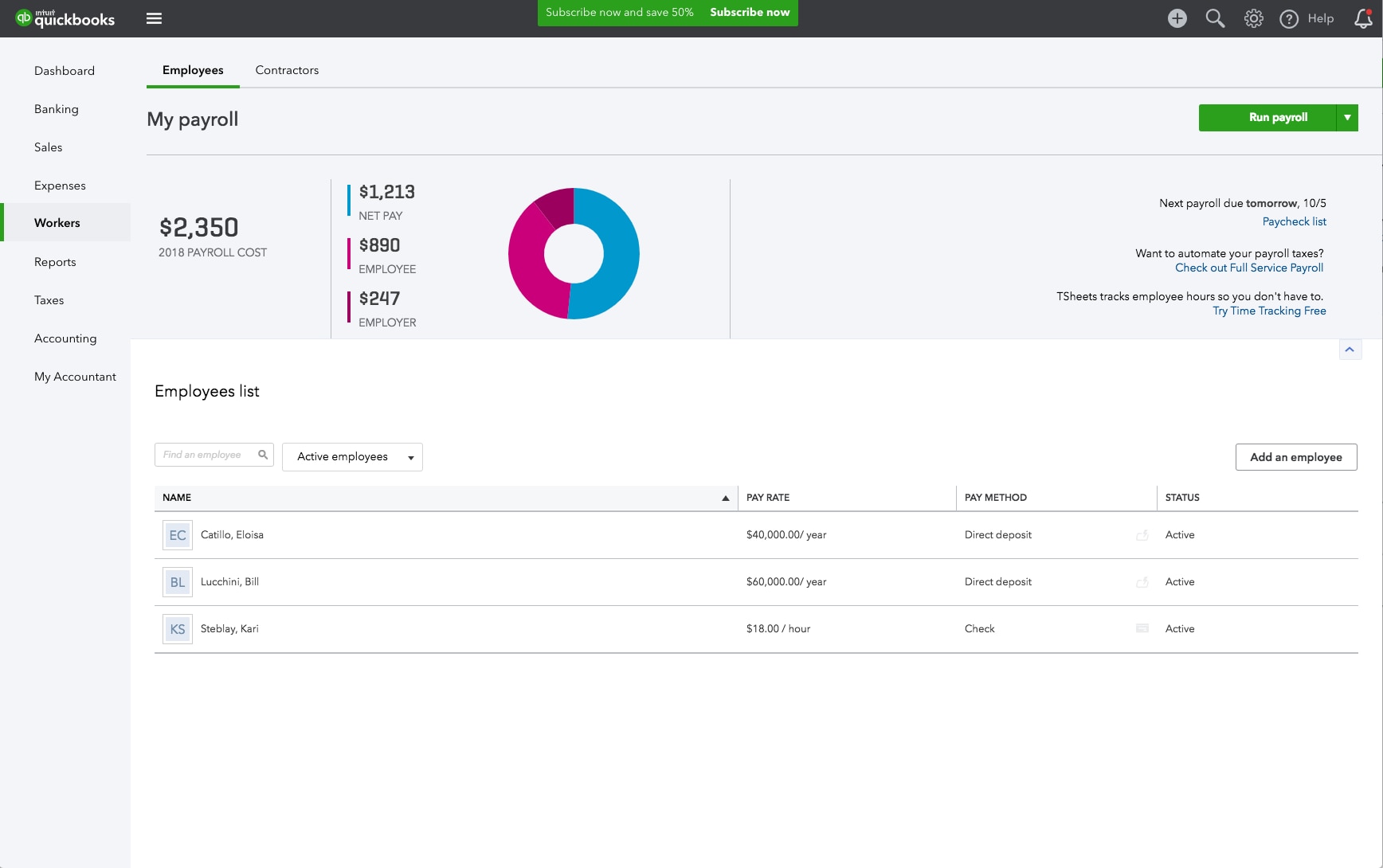

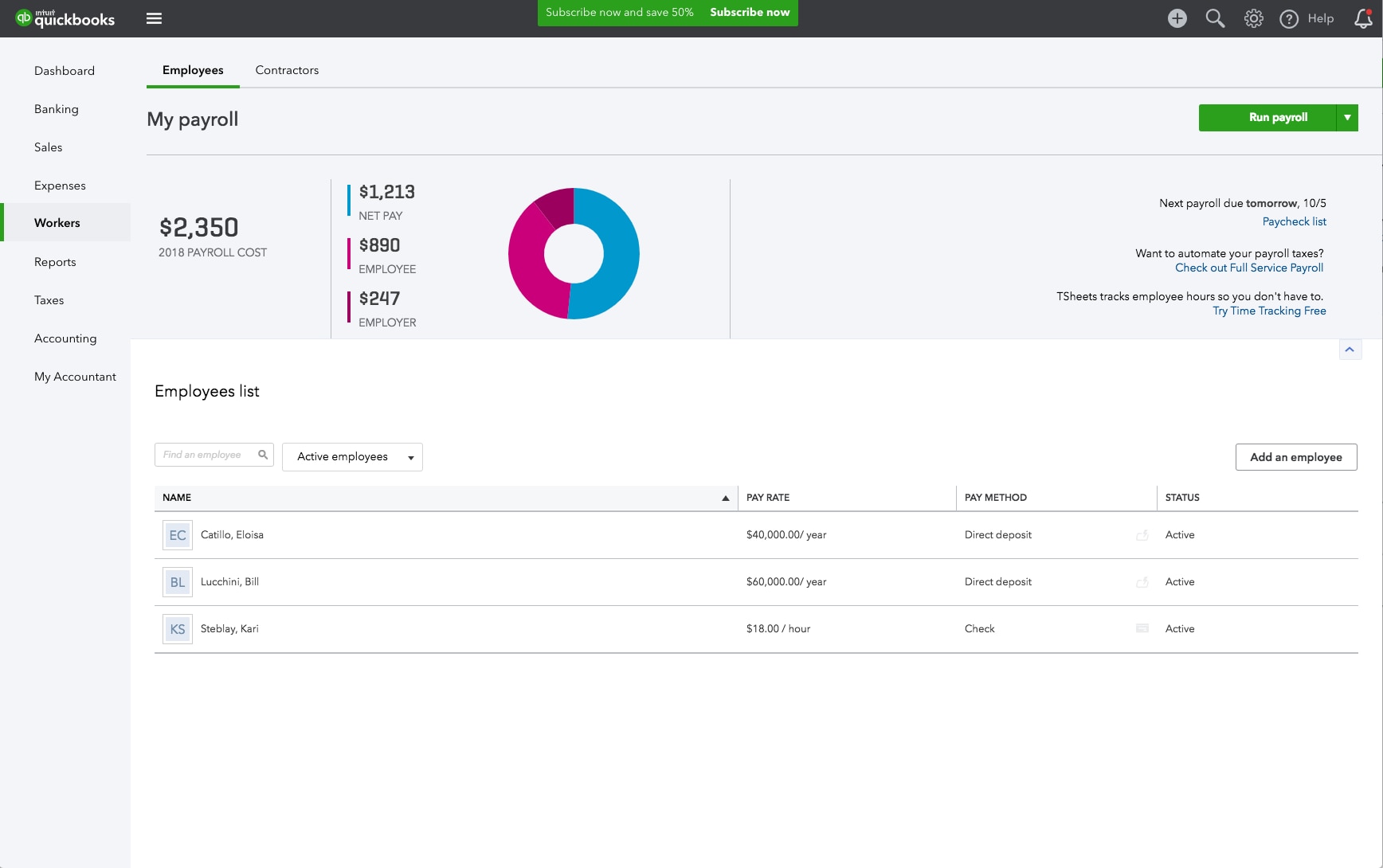

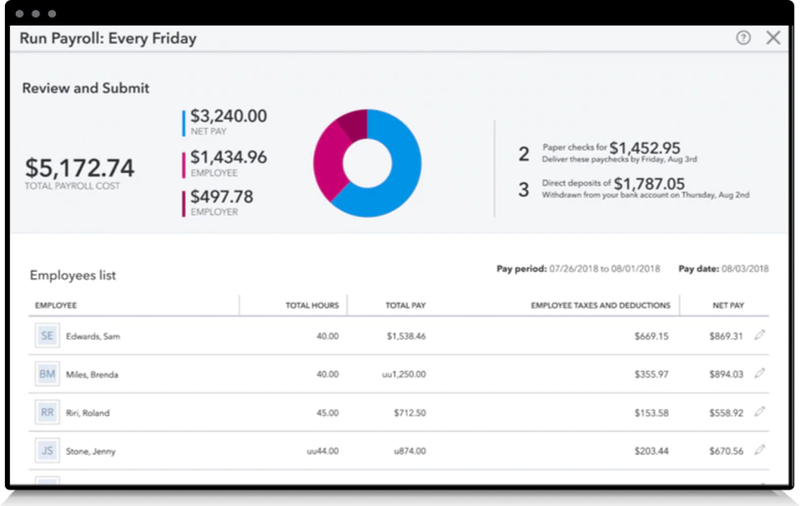

Payroll For Accountants Quickbooks Payroll Solutions Intuit

Payroll For Accountants Quickbooks Payroll Solutions Intuit

What Is Payroll The Complete Guide To Small Business Payroll Wave Blog

How Much Do Accountants Make Accounting Jobs Accounting How To Make

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

Understanding How Much Small Business Payroll Costs

Understanding How Much Small Business Payroll Costs

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

Payroll Accounting Setting Up And Calculating Staff Payrolls

Best Payroll Companies For Small Business 2021 Business Org

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

Online Payroll Services For Accountants Surepayroll

Post a Comment for "How Much Do Accountants Charge To Do Payroll"