How Much Does An Accountant Charge To Run Payroll

Some other factors could. You dont have to be a qualified Accountant to do payroll you can do it yourself many people do.

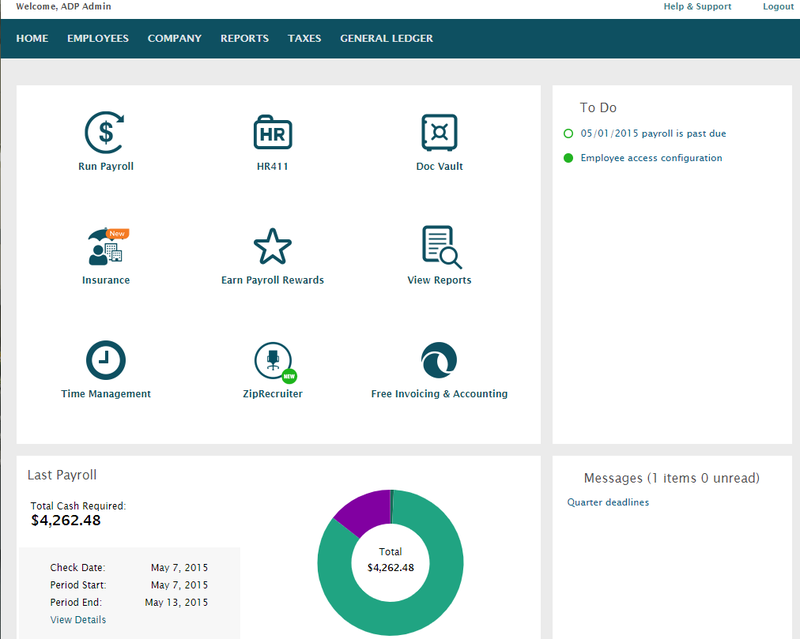

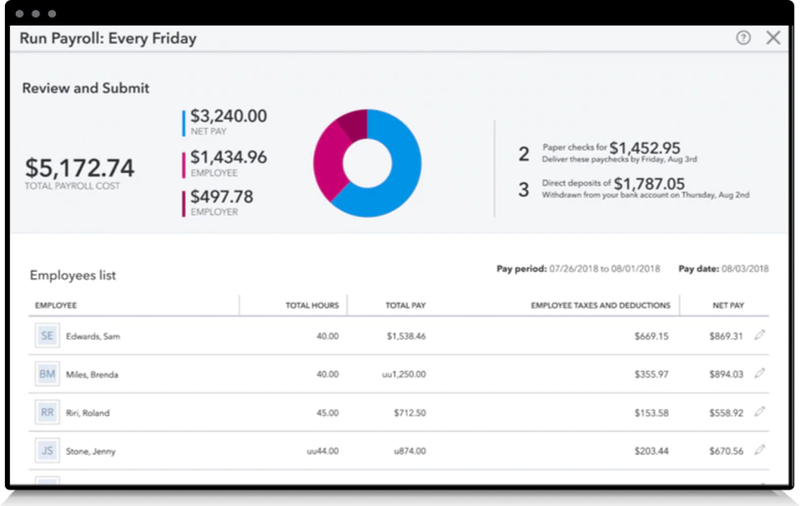

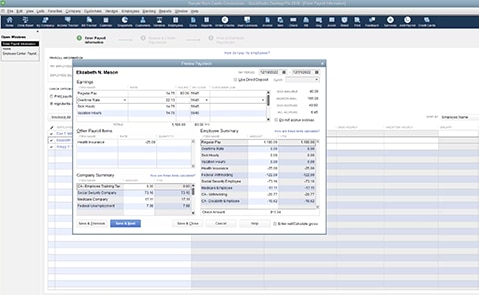

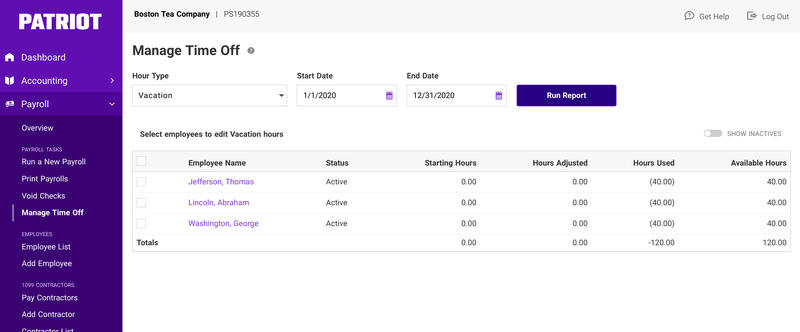

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

If you want someone with a little more experience then accounting fees will go up by 40 to 80 per hour.

How much does an accountant charge to run payroll. However many payroll providers charge around 29-150 for a monthly fee plus a 2-12 fee per employee every pay period. In this instance a standard UK tax return would cost from 75 to 300. Under Your Company select Account and Settings.

Fees for limited companies can vary from as little as 100 to well over 1000 a month depending on the size and complexity of their businesses. Youre responsible for collecting and. This could range from 150 190 per transaction.

Bookkeepers charge between 25hr and 90hr Accounting work completed by a CPA youll find a range of 150hr to 450hr This means that the bill for services provided will vary depending on how long it took your bookkeeper or accountant to complete those services. Multi-state payroll Run payroll for employees working across multiple states. So if the company has say 5 people on the payroll and pay is weekly the cost would be.

When you run payroll by hand the direct costs you need to worry about depend on how you pay employees. How much does an accountant charge to do a tax return. A small business with around ten employees might pay an accountant approximately 250 per month to perform payroll.

Supervisors and senior staff members tend to make on average approximately 100 to 200 per hour. Additionally payroll costs depend on the type of payroll service you want. At current market rates youll find a range of hourly rates.

To get quotes from 3-4 local accountants with experience of working with businesses like yours please fill in the form towards the top of the page. If you decide to pay a payroll provider for example a bureau or accountant to run your payroll youll need to consider how much support youll need. Click the Gear icon.

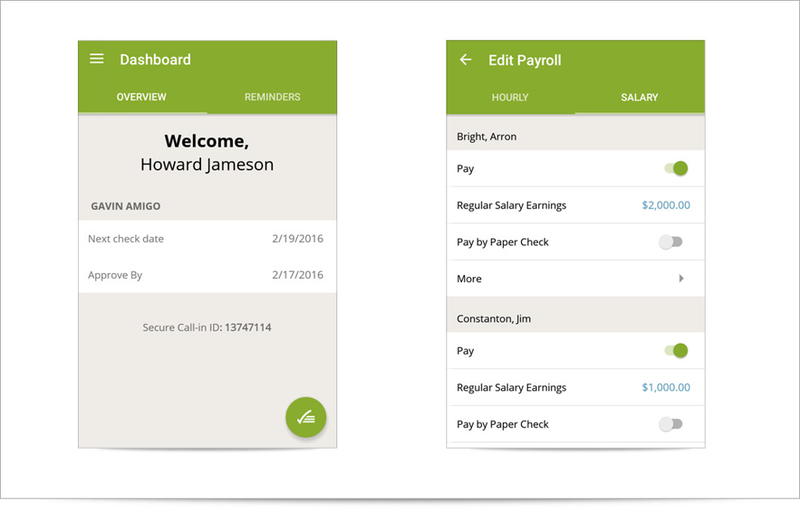

The price of a Payroll Service Provider can vary depending on your area. If youre a small business of ten people or fewer youll typically pay around 4 per employee per month but payroll services costs vary from 5 to 12 per employee per month for SMBs. Next-day direct deposit Run payroll the day before your employees need to be paid.

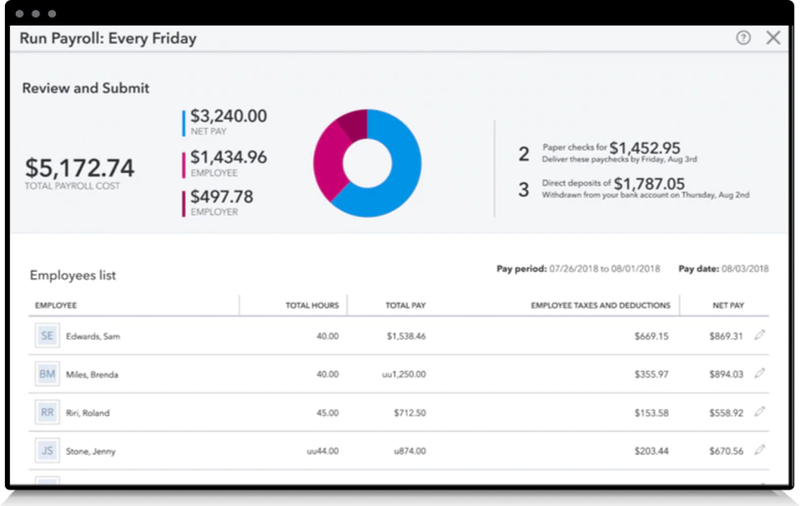

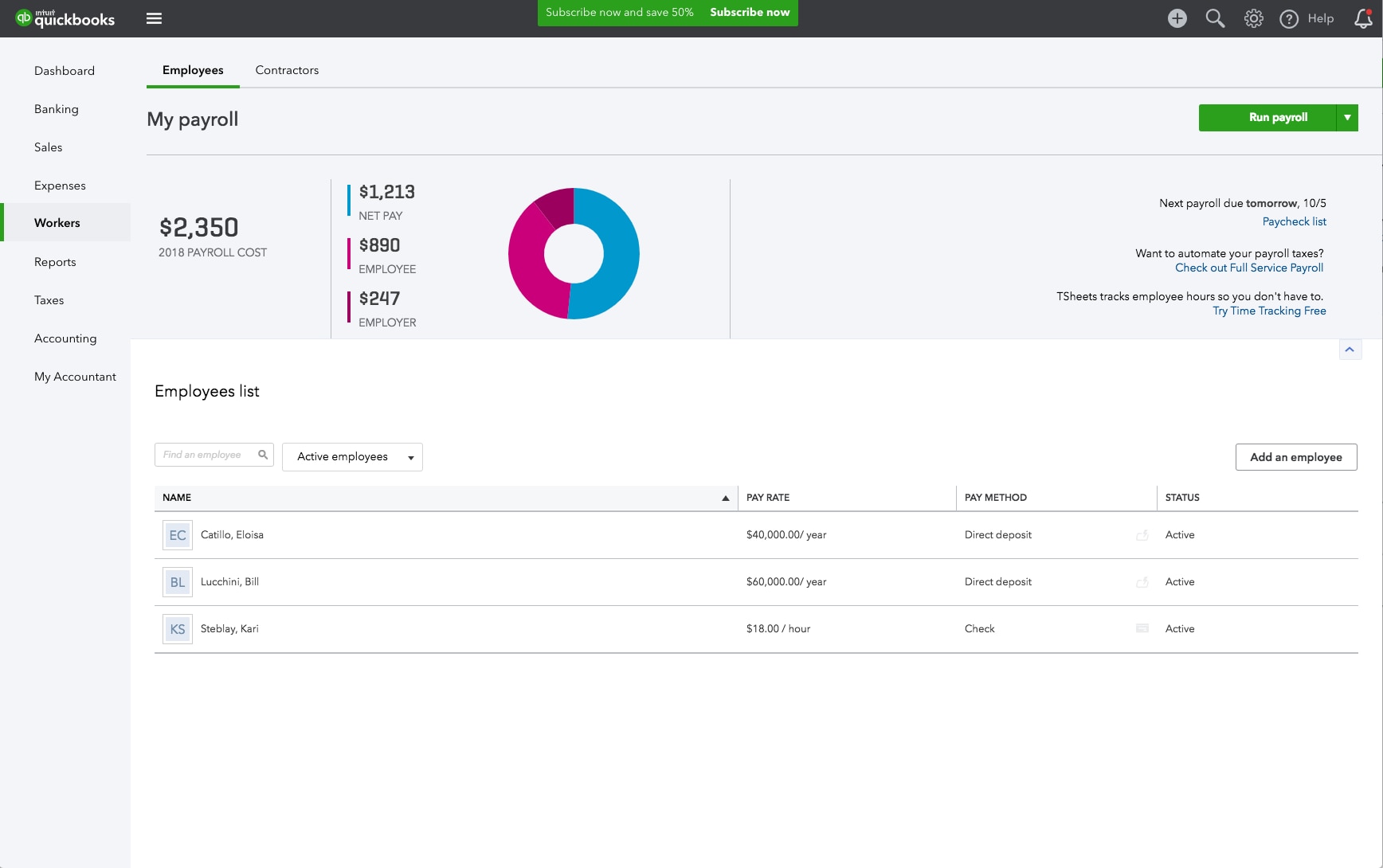

While that may cost more per month it could save you in the long run if you are prone to making tax mistakes. QuickBooks Online payroll costs between 45- 125 month plus 4- 10 month per employee. Be sure to visit the QBO website for a discount on QuickBooks payroll.

You can go to the billing section to review how much you are charged for the payroll subscription. The cost will depend on how often you run your payroll how many employees you have and how complex your payroll structure is. For a small UK business with monthly payroll and with no more than ten staff payroll usually costs around 4-10 per month per employee.

There are many payroll only bureaus who charge around 25 per payment run plus about 150 to 200 per payslip which would produce a cost of around so around 35 per month. If you pay employees via direct deposit you will have to pay fees. Go to the Billing Subscription tab.

Tax filings and payments We automatically file and pay federal state and local payroll taxes. The software would cost you around 100 to do it. The per employee surcharge is only 200 per employee per month.

With its full-service payroll option QuickBooks does it all for you. The average cost for a Payroll Service Provider is 150. If youre working with a CPA junior staff member their hourly rate falls in the 60 to 120 per hour range according to CostOwl.

To hire a Payroll Service Provider to complete your project you are likely to spend between 90 and 150 total. 52 weeks x 4 per weekly payslip x 5 staff. Subscription online payroll services via companies such as Gusto and SurePayroll that work with computer software cost around 75-250 per year.

52 weeks x 10 520 for the year. Go to the Payroll section and check the charge. Intuit often runs payroll promotions for existing QuickBooks Online and for modern QuickBooks users.

There are also some common payroll costs that may either be upfront or hidden. If you are not a business owner then your self-assessment tax return may be more straight forward. So a total of 1560 for the year.

Run payroll in all 50 states. For example if youre looking for a full-service payroll option the cost may be more if youre getting help with tax filing. The cost of payroll services will depend on the size of your businesses.

I think that a charge of 10 to set up each payroll run and then 4 per payslip on each run is about right. You might need to pay a transaction fee each time you transfer money into an employees account.

Keeping Track A Checklist For Your Nonprofit S Month And Year End Accounting Checklist Nonprofit Management

Payroll For Accountants Quickbooks Payroll Solutions Intuit

The Best Tools For Managing Blog Accounting Business Blog Blog Traffic Grow Blog Traffic

How To Run Payroll Reports In Quickbooks Merchant Maverick Quickbooks Pro Quickbooks Quickbooks Payroll

Precision Tax Accounting Inc Free Consultation Full Charge Accountant 407 960 6000 Accounting Firms Macroeconomics Accounting

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

Accounting Month End Close Procedures Checklist Oracle Template Closing Procedure In Sap Perezzies Checklist Month End Accounting

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

Best 5 Payroll Software System For Businesses Reviano Payroll Software Small Business Accounting Small Business Bookkeeping

Sample Company With Accountant Tools Quickbooks Online Quickbooks Accounting

Quickbooks Comforts You To Remain Your Business Running Effortlessly And To Generate The Reports As Per The Wants Quickbooks Quickbooks Pro Quickbooks Payroll

Six Things To Start Tracking In Your Small Business Today Business Writing Accounting Basics Business Motivation

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

7 Top Payroll Software Solutions For Accountants 2021 The Blueprint

Payroll For Accountants Quickbooks Payroll Solutions Intuit

Full Charge Bookkeeper Resume Lovely Bookkeeper Resume Sample Resume Examples Sample Resume Resume

Where Is The Gear Icon In Quickbooks Quickbooks Online Quickbooks Chart Of Accounts

Delete A Pay Run In Quickbooks Online Standard Pay

Bookkeeping Software In 2021 Bookkeeping Software Bookkeeping Quickbooks Online

Post a Comment for "How Much Does An Accountant Charge To Run Payroll"